Folly and Wisdom in Crowds

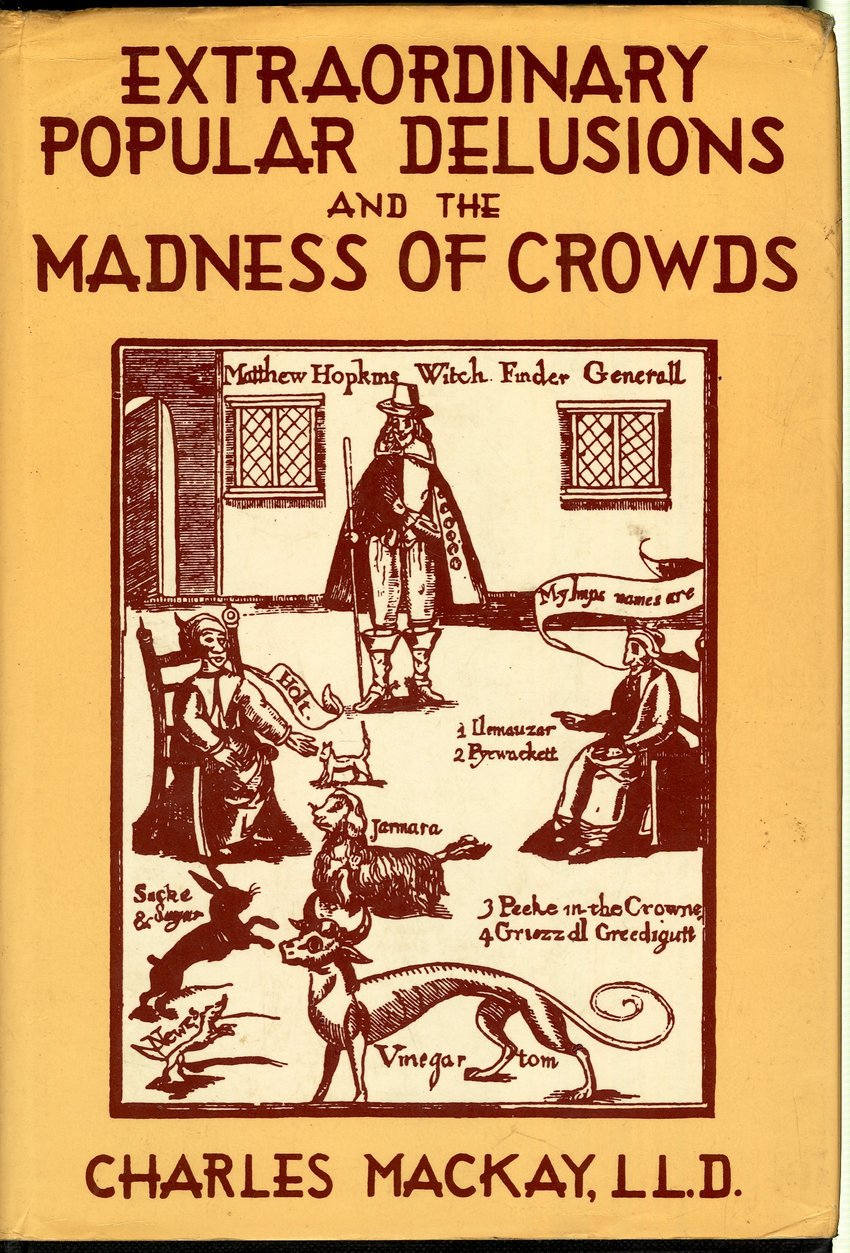

The picture shows the cover of a nineteenth century book on what the author calls crowd madness: silly beliefs that are shared among specific groups with a strong group culture. One of the prime examples in the book is the Dutch tulip mania of the Seventeenth Century. More contemporary examples are the internet bubble at the turn of the century, and the current craze about crypto currencies. Crypto currencies are special in that they have zero intrinsic value, and their day-to-day value is entirely determined by the strength of the group belief in their value. And people get mad with excitement.

In the same way, some people in the Dutch republic got mad with excitement about tulips and mortgaged all their possessions to acquire the precious bulbs. Until the craze ended. The tulips were there to stay, but many people got ruined. Exactly the same thing will happen with bitcoins. But it is no use telling that to people. As Mark Twain said: “It is much easier to fool people than to convince people that they are being fooled.”

A situation where people believe a thing because other people also believe it is called an information cascade. A spectacular example of an information cascade was observed by the American naturalist and adventurer William Beebe (this example is taken from James Surowiecki’s book The Wisdom of Crowds, a different book from the one pictured above). Beebe was studying the behaviour of warrior ants, who, when lost, obey a simple rule: “Follow the ant in front of you.” Beebe came upon a strange sight in Guyana: a group of army ants was moving in a huge circle, 1200 feet in circumference. It took each ant two and a half hours to complete the tour. The ants went round and round for two days, until they all died. If you think people are smarter than ants, then please study some more history and think again.

Independence of judgement is of key importance for making wise group decisions. There is a simple mathematical theorem about this, called Condorcet’s Jury Theorem. Suppose a group made up from an odd number of people wants make a decision by majority voting. One of the two outcomes is correct. E.g., the outcome guilty is correct when the person under trial is indeed guilty of the crime he is accused of. Suppose each of the decision makers has a probability greater than one half of being right. Then Condorcet’s theorem says that the more people there are in the decision making group, the higher the probability that their majority vote gives the correct outcome. See the above Wikipedia link for further details and for a proof of the theorem. But it all hinges on independence of judgement. If there is no independence, cascade effects can lead us astray.

A key example of the wisdom of crowds – of the fact that people sometimes “know” more collectively than individually – in Surowiecki’s book is the following story by Sir Francis Galton:

A weight-judging competition was carried on at the annual show of the West of England Fat Stock and Poultry Exhibition recently held at Plymouth (England). A fat ox having been selected, com- petitors bought stamped and numbered cards, for 6d. each, on which to inscribe their respective names, addresses, and estimates of what the ox would weigh after it had been slaughtered and “dressed.” Those who guessed most successfully received prizes. About 800 tickets were issued, which were kindly lent me for examination after they had fulfilled their immediate purpose.

It turned out that the median – the average – of the guesses on the tickets was only a few pounds above the actual weight of the slaughered ox.

This is a quote from a paper called Vox Populi, the voice of the people. Galton was an aristocrat, and no doubt there is some irony in the title.